Investment Articles

Our Mission to Changes Lives and Create Generational Wealth through Real Estate Investing!

From Finance

Understanding Your Schedule K-1 as a Passive Real Estate Investor

"You don't pay taxes--they take taxes." Chris Rock:

Tax reporting for private real estate investments is not as simple as other forms of investments, such as stocks, and nor even as straightforward as other forms of real estate securities such as real estate investment trusts (REITs). The good news is that the tax benefits of investing directly in real estate actively or passively can be considerably greater than other types of investments, making the paperwork worth it. In this article, we’ll walk you through what you need to know about correctly incorporating a direct real estate investment into your tax return and highlight the generous tax benefits offered to direct real estate investors.

Let's being by talking through the tax information that is necessary to parse through in advance of filing your tax return. First, private real estate investments can take many different forms, a common investment practice is for multiple individuals to come together in either a limited partnership or limited liability company (LLC) and invest in a property. Cramlet Capital provides investors with passive investment opportunities and such are always formed with a LLC. LLC's are required to report each investors financial information to determine the impact of your investments on your individual tax return. This reporting occurs on a Schedule K-1. The information reported includes your share of net rental income, capital, and liabilities of the LLC.

Importance of Schedule K-1 for Private Real Estate Investors

For private placement investors, the Schedule K-1 form is essential for understanding and managing your investments. Unlike public market investments, private placements are not openly traded and are often limited to a select group of investors.

Whether you are actively involved in managing your investments or prefer a passive strategy, the K-1 form offers vital information, including:

Your specific share of income and losses so you can determine the direct financial impact of your investment on tax liabilities.

Ensures accurate investment reporting earnings or losses.

Assists in evaluating the profitability and viability of your investment.

Enables you to anticipate and prepare for potential tax liabilities by showing your taxable income.

Allows you to monitor your investment’s ongoing financial health and progress each year.

Schedule K-1 Explained: Breaking Down the Form

Understanding the different sections of a K-1 can help with accurate completion. You will typically receive one Schedule K-1 per entity you are invested in, although some partnerships are structured to consolidate multiple investments into a single form.

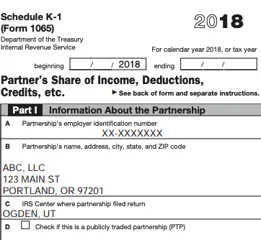

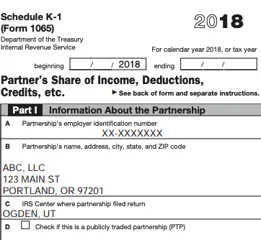

Part I – Your Partnership’s Information. This section lists key qualitative details of your partnership, like its name, address, state, ZIP code, and Employer Identification Number (EIN). If your partnership is publicly traded, there is a checkbox for this, but it is typically left unchecked in private placements.

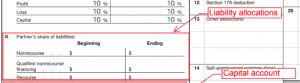

Part II – Your Information as a Partner or Investor. This section outlines your individual investment details, including your name, address, and Tax Identification Number (SSN). It also describes your role in the partnership (general or limited partner) and your domestic or foreign investor status. Sections J, K, L, M, and N summarize your financial shares in the partnership. Other parts cover your capital contributions and property with built-in gains or losses and other pertinent information.

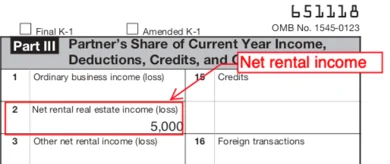

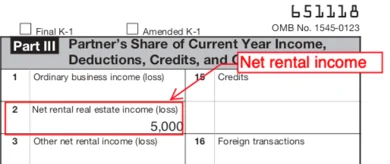

Part III – Your Financial Details in the Partnership. This section discloses your financial involvement in the partnership and displays your share of the partnership’s income, losses, deductions, credits, and other tax items for the year. It may include other financial details such as business, real estate, and self-employment activities.

Net Rental Real Estate Income (Loss)

In order to allocate each investor’s share of the net rental real estate income or loss for the year, the LLC must first calculate the overall net income or loss by determining what is allowed under the Internal Revenue Code (IRC). Taxable income is generally calculated by taking net operating income and deducting interest and depreciation for the year. (The key deduction to remember is depreciation, which will be discussed in part two of this series). Taxable income can also be reduced by any current year capital expenditures that aren’t required to be capitalized for tax purposes under the tangible property regulations.

Once taxable income or loss from rental activities is determined, the LLC allocates an amount to each investor based on the profit and loss allocation provisions in the LLC’s operating agreement. This is due to the fact that a direct real estate investor is able to capture his or her pro-rata share of income or losses. This also stands in stark contrast to REITs and other investments. This allocation may be as simple as multiplying your percentage ownership to taxable income or loss for the LLC. Partnership tax rules allow for flexibility and creativity in how income and loss may be allocated, so it’s important you understand the profit and loss provisions you agreed to when you invested in the LLC.

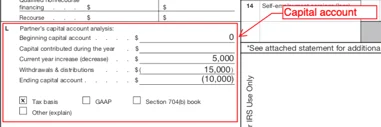

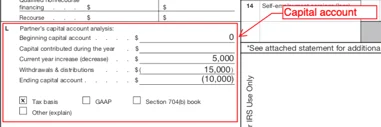

Capital Account

This section of the Schedule K-1 reports the changes to your capital (or equity) in the LLC, including allocation of net income or loss, capital contributions and distributions received during the year. It is important to make note as to which method capital is being reported. If the Schedule K-1 is reported on a tax basis, this amount is added to the liability allocations to calculate overall tax basis* in your investment. If the tax basis box is not checked, you will need to track your tax capital separately each year.

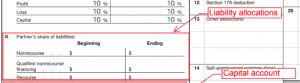

Liabilities

It is common for LLCs that own rental real estate to leverage the property with debt, no different than you may with a mortgage on your primary residence. While banks lend on a lower loan-to-value on investment real estate compared to primary residences, the interest is deductible against rental income collected. When rental real estate is leveraged it’s common for it to have positive cash flow and generate tax losses for a number of years due to interest and depreciation deductions. The IRC limits the ability to take losses or tax-free distributions to the extent of a partner’s basis in their partnership interest. This is where debt plays an important role by providing an additional basis beyond the cash contributions.

Example 1: In 2015, you invested $50,000 for a 10% limited membership interest in ABC LLC, which bought a commercial building for cash. From 2015-2017, ABC LLC does not pay any distributions and allocates to you rental losses of $50,000. In 2018, you received an allocation of $5,000 of rental income and received $15,000 in cash distributions. Your basis in your ABC LLC interest on 1/1/18 was $0 ($50,000 initial capital contribution less $50,000 of allocated rental losses). Later in the year, your basis increased to $5,000 for the rental income allocated immediately before your cash distribution. Since you received distributions in excess of basis, there will be $10,000 of gain to be recognized on your 2018 individual tax return.

Example 2: Same as Example 1, except that ABC LLC incurs debt of $1,000,000 on the building purchase. Assuming no member has personally guaranteed the debt, your allocable share of the debt is $100,000 ($1,000,000 debt x 10% ownership). Your initial basis is now $150,000 in the ABC LLC membership interest ($50,000 cash contributed + $100,000 debt allocated). On 1/1/18, your basis became $100,000 ($150,000 initial basis less $50,000 of allocated rental losses). When ABC LLC pays you the $15,000 cash distribution, it now reduces basis to $90,000 (Your 1/1/18 basis plus $5,000 rental income less $15,000 cash distribution). There is no taxable gain for distributions in excess of basis for you.

The LLC must report to all investors their share of liabilities on Schedule K-1. The tax rules regarding partnership liabilities are some of the most complex in the IRC, but in most situations, the nonrecourse and qualified nonrecourse (QNR) liabilities are allocated based on the investor’s profit percentage. Recourse liabilities are those the investor has personally guaranteed and will be allocated based on specific facts and circumstances relating to those liabilities.

The allocation of liabilities can be important for investors in rental real estate by providing tax basis to take their allocable share of losses. When an LLC allocates a rental real estate loss to you the investor, you are limited to three different ways from taking the loss against other income.

Loss Limitations

The first limitation allows losses only to the extent of tax basis in the LLC interest. If there is sufficient basis, the next limitation allows losses to the extent of at-risk tax basis, which you are economically responsible for. You should know – cash invested carries at-risk basis because if the partnership does not repay this capital then you lose your investment. For investments in limited partnerships or LLCs, you generally are only economically responsible for any liabilities allocated if you personally guaranteed these debts. If the partnership failed to pay on the debt the lender may have legal recourse to demand payment from the guarantor, making them economically responsible for this debt allocation. However, it is uncommon for limited partners to guarantee loans of the partnership or LLC.

The rules around at-risk basis have a carve-out for qualified nonrecourse (QNR) liabilities. For the debt to be classified as QNR it must: be secured by real property, the lender is one that is in the business of lending money, no one is personally liable for the debt and it is not convertible debt. QNR allocations to limited partners are considered at-risk basis for the member. This allows losses to be claimed even though they are not economically responsible for repayment, subject to the passive loss rules.

Example 3: Same as Example 2, except that your allocable losses are $75,000 and ABC LLC borrowed $1,000,000 on the building purchase from an individual not in the trade or business of lending money. On 1/1/18 your basis was $75,000 ($150,000 initial basis less $75,000 of allocated rental losses). Of the $75,000 in losses, you may claim $50,000 of the losses against passive income. The remaining $25,000 are suspended under the at-risk limitations. When ABC LLC pays you the $15,000 cash distribution, it reduces basis to $65,000 (your 1/1/18 basis of $75,000 plus $5,000 rental income less $15,000 cash distribution). There is no taxable gain for distributions in excess of basis.

Example 4: Same as Example 3 except the building loan was obtained from a qualifying lender making the liability allocation QNR. The full $75,000 of loss allocations are available to offset other passive income.

The final hurdle to receiving allocations of rental real estate losses are the passive loss rules. Rental real estate losses are considered passive by default** and can only be used to offset passive income from other sources. Any unused passive losses carry forward indefinitely until there is passive income or until that activity is disposed of.

Example 5: Same as Example 3 and you do not have any other passive investments. You have $50,000 of suspended passive losses and $25,000 of suspended at-risk basis losses, both carrying forward into 2019. In 2019, ABC LLC allocates $30,000 of rental real estate income to you. Since you have $75,000 in total suspended losses there will be no rental real estate income reported on Form 1040. The 2019 income allocation first frees up the suspended at-risk basis losses, then frees up suspended passive losses. You will have $45,000 of suspended passive losses and $0 suspended at-risk losses to carry into 2020.

Depreciation Deductions

Depreciation deductions can often lead to taxable losses for rental real estate investments that have positive cash flow. Depreciation, for tax purposes, is the method by which the cost of an asset is recovered overtime periods set forth by the IRS–27.5 years for residential rental property and 39 years for commercial rental property. This cost recovery (or loss) is applied evenly, or on a straight-line basis, over that time period. (It’s worth noting that this only applies to buildings, depreciation is not allowed on the cost of the land.). Depreciation is derived by completing a Cost Segregation Study and often results in tax free distributions.

Example 1: On 1/1/18, XYZ LLC purchased a commercial building for $5,000,000, with $1,000,000 of the purchase price allocated to land. The net operating income on the building is $300,000 The depreciable life of the building is 39 years. The annual depreciation deduction is $102,564 ($5,000,000 purchase price less $1,000,000 land value = $4,000,000 depreciable basis / 39 years). The net rental real estate income allocated to the LLC investors is $197,436 ($300,000 net operating income less $102,564 depreciation deduction).

Conclusion

As you can see, the tax implications of investing in an LLC are more complex than investing in the stock market. However, that complexity also provides unique benefits, such as the potential to take tax-free distributions in years the LLC generates a tax loss.

Disclaimer:

Cramlet Capital and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Investment Articles

Understanding Your Schedule K-1 as a Passive Real Estate Investor

"You don't pay taxes--they take taxes." Chris Rock:

Tax reporting for private real estate investments is not as simple as other forms of investments, such as stocks, and nor even as straightforward as other forms of real estate securities such as real estate investment trusts (REITs). The good news is that the tax benefits of investing directly in real estate actively or passively can be considerably greater than other types of investments, making the paperwork worth it. In this article, we’ll walk you through what you need to know about correctly incorporating a direct real estate investment into your tax return and highlight the generous tax benefits offered to direct real estate investors.

Let's being by talking through the tax information that is necessary to parse through in advance of filing your tax return. First, private real estate investments can take many different forms, a common investment practice is for multiple individuals to come together in either a limited partnership or limited liability company (LLC) and invest in a property. Cramlet Capital provides investors with passive investment opportunities and such are always formed with a LLC. LLC's are required to report each investors financial information to determine the impact of your investments on your individual tax return. This reporting occurs on a Schedule K-1. The information reported includes your share of net rental income, capital, and liabilities of the LLC.

Importance of Schedule K-1 for Private Real Estate Investors

For private placement investors, the Schedule K-1 form is essential for understanding and managing your investments. Unlike public market investments, private placements are not openly traded and are often limited to a select group of investors.

Whether you are actively involved in managing your investments or prefer a passive strategy, the K-1 form offers vital information, including:

Your specific share of income and losses so you can determine the direct financial impact of your investment on tax liabilities.

Ensures accurate investment reporting earnings or losses.

Assists in evaluating the profitability and viability of your investment.

Enables you to anticipate and prepare for potential tax liabilities by showing your taxable income.

Allows you to monitor your investment’s ongoing financial health and progress each year.

Schedule K-1 Explained: Breaking Down the Form

Understanding the different sections of a K-1 can help with accurate completion. You will typically receive one Schedule K-1 per entity you are invested in, although some partnerships are structured to consolidate multiple investments into a single form.

Part I – Your Partnership’s Information. This section lists key qualitative details of your partnership, like its name, address, state, ZIP code, and Employer Identification Number (EIN). If your partnership is publicly traded, there is a checkbox for this, but it is typically left unchecked in private placements.

Part II – Your Information as a Partner or Investor. This section outlines your individual investment details, including your name, address, and Tax Identification Number (SSN). It also describes your role in the partnership (general or limited partner) and your domestic or foreign investor status. Sections J, K, L, M, and N summarize your financial shares in the partnership. Other parts cover your capital contributions and property with built-in gains or losses and other pertinent information.

Part III – Your Financial Details in the Partnership. This section discloses your financial involvement in the partnership and displays your share of the partnership’s income, losses, deductions, credits, and other tax items for the year. It may include other financial details such as business, real estate, and self-employment activities.

Net Rental Real Estate Income (Loss)

In order to allocate each investor’s share of the net rental real estate income or loss for the year, the LLC must first calculate the overall net income or loss by determining what is allowed under the Internal Revenue Code (IRC). Taxable income is generally calculated by taking net operating income and deducting interest and depreciation for the year. (The key deduction to remember is depreciation, which will be discussed in part two of this series). Taxable income can also be reduced by any current year capital expenditures that aren’t required to be capitalized for tax purposes under the tangible property regulations.

Once taxable income or loss from rental activities is determined, the LLC allocates an amount to each investor based on the profit and loss allocation provisions in the LLC’s operating agreement. This is due to the fact that a direct real estate investor is able to capture his or her pro-rata share of income or losses. This also stands in stark contrast to REITs and other investments. This allocation may be as simple as multiplying your percentage ownership to taxable income or loss for the LLC. Partnership tax rules allow for flexibility and creativity in how income and loss may be allocated, so it’s important you understand the profit and loss provisions you agreed to when you invested in the LLC.

Capital Account

This section of the Schedule K-1 reports the changes to your capital (or equity) in the LLC, including allocation of net income or loss, capital contributions and distributions received during the year. It is important to make note as to which method capital is being reported. If the Schedule K-1 is reported on a tax basis, this amount is added to the liability allocations to calculate overall tax basis* in your investment. If the tax basis box is not checked, you will need to track your tax capital separately each year.

Liabilities

It is common for LLCs that own rental real estate to leverage the property with debt, no different than you may with a mortgage on your primary residence. While banks lend on a lower loan-to-value on investment real estate compared to primary residences, the interest is deductible against rental income collected. When rental real estate is leveraged it’s common for it to have positive cash flow and generate tax losses for a number of years due to interest and depreciation deductions. The IRC limits the ability to take losses or tax-free distributions to the extent of a partner’s basis in their partnership interest. This is where debt plays an important role by providing an additional basis beyond the cash contributions.

Example 1: In 2015, you invested $50,000 for a 10% limited membership interest in ABC LLC, which bought a commercial building for cash. From 2015-2017, ABC LLC does not pay any distributions and allocates to you rental losses of $50,000. In 2018, you received an allocation of $5,000 of rental income and received $15,000 in cash distributions. Your basis in your ABC LLC interest on 1/1/18 was $0 ($50,000 initial capital contribution less $50,000 of allocated rental losses). Later in the year, your basis increased to $5,000 for the rental income allocated immediately before your cash distribution. Since you received distributions in excess of basis, there will be $10,000 of gain to be recognized on your 2018 individual tax return.

Example 2: Same as Example 1, except that ABC LLC incurs debt of $1,000,000 on the building purchase. Assuming no member has personally guaranteed the debt, your allocable share of the debt is $100,000 ($1,000,000 debt x 10% ownership). Your initial basis is now $150,000 in the ABC LLC membership interest ($50,000 cash contributed + $100,000 debt allocated). On 1/1/18, your basis became $100,000 ($150,000 initial basis less $50,000 of allocated rental losses). When ABC LLC pays you the $15,000 cash distribution, it now reduces basis to $90,000 (Your 1/1/18 basis plus $5,000 rental income less $15,000 cash distribution). There is no taxable gain for distributions in excess of basis for you.

The LLC must report to all investors their share of liabilities on Schedule K-1. The tax rules regarding partnership liabilities are some of the most complex in the IRC, but in most situations, the nonrecourse and qualified nonrecourse (QNR) liabilities are allocated based on the investor’s profit percentage. Recourse liabilities are those the investor has personally guaranteed and will be allocated based on specific facts and circumstances relating to those liabilities.

The allocation of liabilities can be important for investors in rental real estate by providing tax basis to take their allocable share of losses. When an LLC allocates a rental real estate loss to you the investor, you are limited to three different ways from taking the loss against other income.

Loss Limitations

The first limitation allows losses only to the extent of tax basis in the LLC interest. If there is sufficient basis, the next limitation allows losses to the extent of at-risk tax basis, which you are economically responsible for. You should know – cash invested carries at-risk basis because if the partnership does not repay this capital then you lose your investment. For investments in limited partnerships or LLCs, you generally are only economically responsible for any liabilities allocated if you personally guaranteed these debts. If the partnership failed to pay on the debt the lender may have legal recourse to demand payment from the guarantor, making them economically responsible for this debt allocation. However, it is uncommon for limited partners to guarantee loans of the partnership or LLC.

The rules around at-risk basis have a carve-out for qualified nonrecourse (QNR) liabilities. For the debt to be classified as QNR it must: be secured by real property, the lender is one that is in the business of lending money, no one is personally liable for the debt and it is not convertible debt. QNR allocations to limited partners are considered at-risk basis for the member. This allows losses to be claimed even though they are not economically responsible for repayment, subject to the passive loss rules.

Example 3: Same as Example 2, except that your allocable losses are $75,000 and ABC LLC borrowed $1,000,000 on the building purchase from an individual not in the trade or business of lending money. On 1/1/18 your basis was $75,000 ($150,000 initial basis less $75,000 of allocated rental losses). Of the $75,000 in losses, you may claim $50,000 of the losses against passive income. The remaining $25,000 are suspended under the at-risk limitations. When ABC LLC pays you the $15,000 cash distribution, it reduces basis to $65,000 (your 1/1/18 basis of $75,000 plus $5,000 rental income less $15,000 cash distribution). There is no taxable gain for distributions in excess of basis.

Example 4: Same as Example 3 except the building loan was obtained from a qualifying lender making the liability allocation QNR. The full $75,000 of loss allocations are available to offset other passive income.

The final hurdle to receiving allocations of rental real estate losses are the passive loss rules. Rental real estate losses are considered passive by default** and can only be used to offset passive income from other sources. Any unused passive losses carry forward indefinitely until there is passive income or until that activity is disposed of.

Example 5: Same as Example 3 and you do not have any other passive investments. You have $50,000 of suspended passive losses and $25,000 of suspended at-risk basis losses, both carrying forward into 2019. In 2019, ABC LLC allocates $30,000 of rental real estate income to you. Since you have $75,000 in total suspended losses there will be no rental real estate income reported on Form 1040. The 2019 income allocation first frees up the suspended at-risk basis losses, then frees up suspended passive losses. You will have $45,000 of suspended passive losses and $0 suspended at-risk losses to carry into 2020.

Depreciation Deductions

Depreciation deductions can often lead to taxable losses for rental real estate investments that have positive cash flow. Depreciation, for tax purposes, is the method by which the cost of an asset is recovered overtime periods set forth by the IRS–27.5 years for residential rental property and 39 years for commercial rental property. This cost recovery (or loss) is applied evenly, or on a straight-line basis, over that time period. (It’s worth noting that this only applies to buildings, depreciation is not allowed on the cost of the land.). Depreciation is derived by completing a Cost Segregation Study and often results in tax free distributions.

Example 1: On 1/1/18, XYZ LLC purchased a commercial building for $5,000,000, with $1,000,000 of the purchase price allocated to land. The net operating income on the building is $300,000 The depreciable life of the building is 39 years. The annual depreciation deduction is $102,564 ($5,000,000 purchase price less $1,000,000 land value = $4,000,000 depreciable basis / 39 years). The net rental real estate income allocated to the LLC investors is $197,436 ($300,000 net operating income less $102,564 depreciation deduction).

Conclusion

As you can see, the tax implications of investing in an LLC are more complex than investing in the stock market. However, that complexity also provides unique benefits, such as the potential to take tax-free distributions in years the LLC generates a tax loss.

Disclaimer:

Cramlet Capital and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Copyright © 2024 Cramlet Capital. All rights reserved.