Investment Articles

Our Mission to Changes Lives and Create Generational Wealth through Real Estate Investing!

From Finance

Can K-1 Losses Offset W-2 Income at Tax Time

“ Albert Einstein: "The hardest thing in the world to understand is the income tax."

When it comes to taxes in real estate, grasping the nuances of every little concept helps. Understanding the tax code and taking advantage of all available deductions and credits can help you keep more of your hard-earned money. K-1 losses are one strategy that investors can use to reduce their tax liability. In this article we will explore the ability to K-1 Losses in passive real estate investing to offset W-2 Income.

What Are K-1 Losses?

K-1 losses are losses generated in a Real Estate syndication passed through to its partners or shareholders (also known as passive investors) on their K1 tax forms. These losses can result from various activities, including depreciation, expenses, and other deductions that reduce the partnership’s taxable income.

For example, suppose you invest as a passive partner alongside the active partners in a multifamily syndication. If the partnership generates a loss for the year, that loss will be allocated to you based on your percentage ownership in the partnership. These losses are primarily used to offset your passive income from the investment. In some scenarios, you can then use this loss to offset your other income, such as your W-2 income.

When you receive a Schedule K-1 tax form, it will include information on the income, deductions, and losses allocated to you for the year. You can use the losses assigned to you to offset other income on your returns, subject to certain limitations. However, note that not all K-1 losses are created equal, and there are two basic types – passive and non-passive losses.

You can use passive losses to offset only passive income, such as rental income, and it cannot be used to offset non-passive income, such as W-2 income. On the other hand, non-passive losses can be used to offset any type of income, including W-2 income.

How K-1 Losses Can Offset W-2 Income

When you invest in a multifamily syndication, you're likely to encounter depreciation. This is a non-cash expense that the Internal Revenue Service (IRS) allows you to deduct from your taxable income, effectively creating a "paper loss." The paper loss shows up on the K-1 tax form you receive from the property and can be used to offset your W-2 income in two separate scenarios.

Scenario 1: Adjusted Gross Income (AGI) of Less than $150,000: A certain amount of deprecation can be used in this scenario. Let's consider a practical example. John is an IT professional with a W-2 income of $120,000 per year. He also owns a 12-unit multifamily property. The property generates $24,000 in net rental income annually, but John can claim $30,000 in depreciation thanks to the building's wear and tear, improvements, and the value of the items inside the property (e.g., appliances and carpeting).

So, despite making a profit on his rental property, John's K-1 shows a loss of $6,000 ($30,000–$24,000). This loss can be used to offset John's W-2 income, reducing it from $120,000 to $114,000. As a result, John will only pay taxes on $114,000 instead of $120,000.

Scenario 2: Having a Real Estate Professional: It's important to understand that the rules for offsetting W-2 income with K-1 losses are complex and multifaceted, largely dictated by the IRS. These regulations often hinge on your status as a "real estate professional" which necessitates specific criteria wherein Real Estate Professionals can use depreciation created through cost segregation to offset the active income.

Cost Segregation in Multifamily Investments

Cost segregation is another strategic tool that can enhance the benefits of investing in multifamily properties. Essentially, cost segregation is a tax strategy that allows investors to accelerate depreciation deductions on certain elements of a property. Instead of depreciating the entire property over a it’s useful life of 27.5 years, cost segregation identifies and separates personal property assets, which have a shorter useful life and can be depreciated over a much shorter timescale—typically 5, 7 or 15 years.

This advanced depreciation can result in significant tax benefits in the early years of an investment, At MFI Partners we engage with a cost segregation specialist to carry out a detailed cost segregation study and ensure the strategy is applied correctly. The capital improvements made to a property often can be depreciated in the first 5 or 7 years.

Bonus Depreciation:

Bonus depreciation is an accelerated business tax deduction. Instead of allocating the deduction over the useful life of an asset, Congress enacted rules that allow investors to deduct 100% of the losses from the cost segregation on their K-1 in the first year.

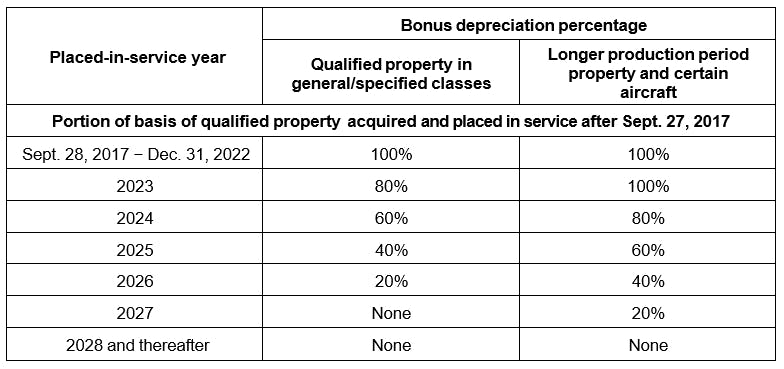

The 2017 Tax Cuts and Jobs Act increased depreciations, and made fundamental changes to taxing international income. However Bonus Depreciation is a fleeing tax benefit that begins to phase out at the end of the 2022 Tax Year and eventually disappears in 2027.

The longer an investor waits to invest, the lower the bonus depreciation that can be used in the first year. The remaining deprecation can be used to offset the profits from the investment.

Conclusion:

Leveraging multifamily investing and utilizing K-1 losses can provide a valuable strategy for offsetting passive income from passive multifamily investment and in certain cases active income like W-2 income during tax time. By taking advantage of this opportunity, investors can reduce their tax liabilities while still adding to their overall wealth.

As with any tax strategy, investors should always consult with their licensed tax professional for tax advice. This article is not intended, nor should be construed, as providing tax, investment, or legal advice.

Investment Articles

Can K-1 Losses Offset W-2 Income at Tax Time

“ Albert Einstein: "The hardest thing in the world to understand is the income tax."

When it comes to taxes in real estate, grasping the nuances of every little concept helps. Understanding the tax code and taking advantage of all available deductions and credits can help you keep more of your hard-earned money. K-1 losses are one strategy that investors can use to reduce their tax liability. In this article we will explore the ability to K-1 Losses in passive real estate investing to offset W-2 Income.

What Are K-1 Losses?

K-1 losses are losses generated in a Real Estate syndication passed through to its partners or shareholders (also known as passive investors) on their K1 tax forms. These losses can result from various activities, including depreciation, expenses, and other deductions that reduce the partnership’s taxable income.

For example, suppose you invest as a passive partner alongside the active partners in a multifamily syndication. If the partnership generates a loss for the year, that loss will be allocated to you based on your percentage ownership in the partnership. These losses are primarily used to offset your passive income from the investment. In some scenarios, you can then use this loss to offset your other income, such as your W-2 income.

When you receive a Schedule K-1 tax form, it will include information on the income, deductions, and losses allocated to you for the year. You can use the losses assigned to you to offset other income on your returns, subject to certain limitations. However, note that not all K-1 losses are created equal, and there are two basic types – passive and non-passive losses.

You can use passive losses to offset only passive income, such as rental income, and it cannot be used to offset non-passive income, such as W-2 income. On the other hand, non-passive losses can be used to offset any type of income, including W-2 income.

How K-1 Losses Can Offset W-2 Income

When you invest in a multifamily syndication, you're likely to encounter depreciation. This is a non-cash expense that the Internal Revenue Service (IRS) allows you to deduct from your taxable income, effectively creating a "paper loss." The paper loss shows up on the K-1 tax form you receive from the property and can be used to offset your W-2 income in two separate scenarios.

Scenario 1: Adjusted Gross Income (AGI) of Less than $150,000: A certain amount of deprecation can be used in this scenario. Let's consider a practical example. John is an IT professional with a W-2 income of $120,000 per year. He also owns a 12-unit multifamily property. The property generates $24,000 in net rental income annually, but John can claim $30,000 in depreciation thanks to the building's wear and tear, improvements, and the value of the items inside the property (e.g., appliances and carpeting).

So, despite making a profit on his rental property, John's K-1 shows a loss of $6,000 ($30,000–$24,000). This loss can be used to offset John's W-2 income, reducing it from $120,000 to $114,000. As a result, John will only pay taxes on $114,000 instead of $120,000.

Scenario 2: Having a Real Estate Professional: It's important to understand that the rules for offsetting W-2 income with K-1 losses are complex and multifaceted, largely dictated by the IRS. These regulations often hinge on your status as a "real estate professional" which necessitates specific criteria wherein Real Estate Professionals can use depreciation created through cost segregation to offset the active income.

Cost Segregation in Multifamily Investments

Cost segregation is another strategic tool that can enhance the benefits of investing in multifamily properties. Essentially, cost segregation is a tax strategy that allows investors to accelerate depreciation deductions on certain elements of a property. Instead of depreciating the entire property over a it’s useful life of 27.5 years, cost segregation identifies and separates personal property assets, which have a shorter useful life and can be depreciated over a much shorter timescale—typically 5, 7 or 15 years.

This advanced depreciation can result in significant tax benefits in the early years of an investment, At MFI Partners we engage with a cost segregation specialist to carry out a detailed cost segregation study and ensure the strategy is applied correctly. The capital improvements made to a property often can be depreciated in the first 5 or 7 years.

Bonus Depreciation:

Bonus depreciation is an accelerated business tax deduction. Instead of allocating the deduction over the useful life of an asset, Congress enacted rules that allow investors to deduct 100% of the losses from the cost segregation on their K-1 in the first year.

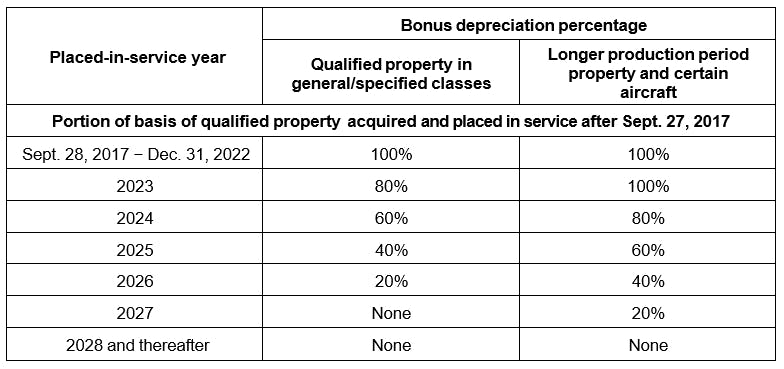

The 2017 Tax Cuts and Jobs Act increased depreciations, and made fundamental changes to taxing international income. However Bonus Depreciation is a fleeing tax benefit that begins to phase out at the end of the 2022 Tax Year and eventually disappears in 2027.

The longer an investor waits to invest, the lower the bonus depreciation that can be used in the first year. The remaining deprecation can be used to offset the profits from the investment.

Conclusion:

Leveraging multifamily investing and utilizing K-1 losses can provide a valuable strategy for offsetting passive income from passive multifamily investment and in certain cases active income like W-2 income during tax time. By taking advantage of this opportunity, investors can reduce their tax liabilities while still adding to their overall wealth.

As with any tax strategy, investors should always consult with their licensed tax professional for tax advice. This article is not intended, nor should be construed, as providing tax, investment, or legal advice.

Copyright © 2025 Cramlet Capital. All rights reserved.